An unsecured loan are an unsecured, fixed-price mortgage useful private, rather than business, explanations. Of the unsecured, we imply it’s not necessary to set-out one collateral. Examine that it having a mortgage or car loan, the spot where the financial can be repossess possessions if you cannot pay back the loan.

As signature loans are unsecured, they want a certain amount of underwriting, and therefore the lender must feel safe adequate regarding your creditworthiness to offer the loan. Underwriting is additionally the foundation based on how much the lending company usually provide you with and how far focus it’s going to costs.

The means to access a consumer loan largely rests on the creditworthiness and you will your loans-to-income ratio. To evaluate your creditworthiness which is, the chance that you’ll pay off the borrowed funds timely personal bank loan business look at the credit score and you may credit score that have one or more of one’s major credit bureaus Experian, TransUnion or Equifax. The best credit rating is actually FICO, which have a variety of 300 so you can 850. It’s problematical to find a consumer loan which have a rating lower than 700, and you may nearly impossible to own results lower than 600.

Availability in addition to varies by the type of personal loan supplier. Lenders regarding personal loan field are banks, borrowing unions an internet-based lenders, which might be certainly one of three products:

- Direct: the web based financial supplies the financing continues playing with internal funding and money from traders

- Fellow in order to peer: this site encourages funds between individual borrowers and you may lenders

- Matching: this site suits your loan consult to 1 or more users of the member lending circle

The type of bank impacts the cost and you will use of regarding a good personal bank loan, which will enter their considerations when picking a lender. In general, banking institutions and you can borrowing unions feel the reduced-rates personal loans however they are most particular about who it provide. Banks usually have the essential stringent underwriting conditions and you may borrowing unions want subscription to get into fund, although they always supply the best pricing as they are non-earnings. On line loan providers promote access to most individuals one to satisfy minimal requirements, nevertheless they charge more banking companies.

Annual percentage rate is even a yearly rates, it comes with charges, that will be reduced otherwise higher, depending on the lender

- Getting a You.S. citizen or resident alien of age 18 or older

- That have a reliable and you will proven source of income

- Getting files such as Personal Safeguards number, checking account information and much more

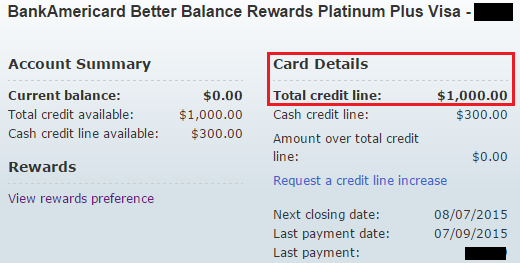

The debt-to-earnings proportion ‘s the proportion out-of borrowing available to borrowing from the bank used. Its mirrored on your own FICO get which can be tend to experienced separately too. Lenders score scared after you request an unsecured loan just after you have exhausted your existing borrowing from the bank resources such as mastercard limitations.

For those who have excellent credit, you can probably secure an unsecured loan to have an annual commission price (APR) around six% to eight%. Within opposite end of the range, should your credit history is in the reduced 600s, you might be thinking about an annual percentage rate surpassing 29% or even forty%. When it comes down to provided FICO get, you could find cost you to differ by as much as 5 payment issues certainly lenders.

When you compare can cost you, it is important to identify between interest and you will ount interesting you are going to purchase your installment loan company Riverside OH loan, toward an annualized foundation.

The preferred commission is known as a keen origination payment. It’s reviewed in advance and you will, such as for instance situations into the a mortgage, it really enhances the lender’s profit return. An enormous origination percentage can establish an apr rather greater than the newest stated interest. Almost every other fees become wary of are prepayment penalties (should you need to pay the personal financing early), later fees and you can uncollectable payment charges.

Some other desire-related consideration is the procedure the financial institution uses to calculate attract fees, as this may affect the total price if you prepay your loan. An informed price you can get is called effortless appeal, in which you pay every month the amount of attention you to definitely has actually accrued in your balance since your past payment.

You’ll want to prevent lenders just who charges pre-calculated notice. This really is a procedure where the whole appeal pricing to have the definition of of your loan was additional straight to the very first financing equilibrium. If you repay the loan at the conclusion of the fresh new mentioned name, i don’t have cost difference between simple focus and pre-calculated focus. not, if you intend to retire the debt early, the latest pre-computed focus approach can cost you additional money.

Banks is notoriously sluggish in terms of approving personal loans, and usually need the most documents. You could constantly use on line, if the bank was quick, you might have to visit a branch office to make use of. Credit unions is actually maybe a little while less much less cumbersome, since you provided certain information after you became an associate.

On the internet loan providers have fun with sleek apps, make small conclusion and you may deposit loan proceeds in the account within a business few days. An online financial can be more versatile if you’d like to switch the payment time or replace the mortgage ahead of it is fully paid.

AA personal loan can be used for other reason. Getting one may allows you to finance larger-solution sales otherwise consolidate loans. Prior to signing right up getting a consumer loan, check around among some other providers and you will envision choices like secured money, bank card advances and you will family collateral finance.

Of numerous consumers thought benefits to-be an important facet when deciding on a personal loan vendor

*Applications submitted on this site is financed by one of numerous lenders, including: FinWise Lender, good Utah-chartered bank, Associate FDIC; Seaside Society Bank, Affiliate FDIC; Midland Says Bank, Representative FDIC; and you can LendingPoint, an authorized bank in certain claims. Mortgage recognition is not secured. Actual mortgage has the benefit of and you can financing number, conditions and you can yearly percentage pricing (« APR ») can differ based upon LendingPoint’s proprietary rating and you may underwriting human body’s comment of your borrowing from the bank, monetary condition, additional factors, and you may help files or guidance your provide. Origination or any other charge from 0% in order to eight% may implement depending on your state of residence. Upon finally underwriting approval to pay for that loan, told you funds are often delivered via ACH the following low-vacation business day. Finance are provided from $dos,100000 in order to $thirty six,500, in the prices anywhere between seven.99% to % ounts use when you look at the Georgia, $3,500; Texas, $step three,001; and you may Their state, $1,500. For a highly-accredited buyers, an effective $10,000 mortgage for a time period of forty eight months with an apr of % and you may origination percentage regarding seven% are certain to get an installment away from $ per month. (Actual terms and conditions and you will rates trust credit score, money, or any other situations.) The newest $fifteen, complete amount owed according to the financing words considering by way of example contained in this disclaimer comes with the brand new origination percentage funded as well as the borrowed funds number. Customers have the option to help you subtract the origination commission from the new disbursed amount borrowed when the wished. When your origination percentage try added to the new financed matter, interest are energized for the complete principal matter. The amount owed ‘s the full level of the mortgage there’ll be paid down once you’ve produced most of the repayments once the booked.